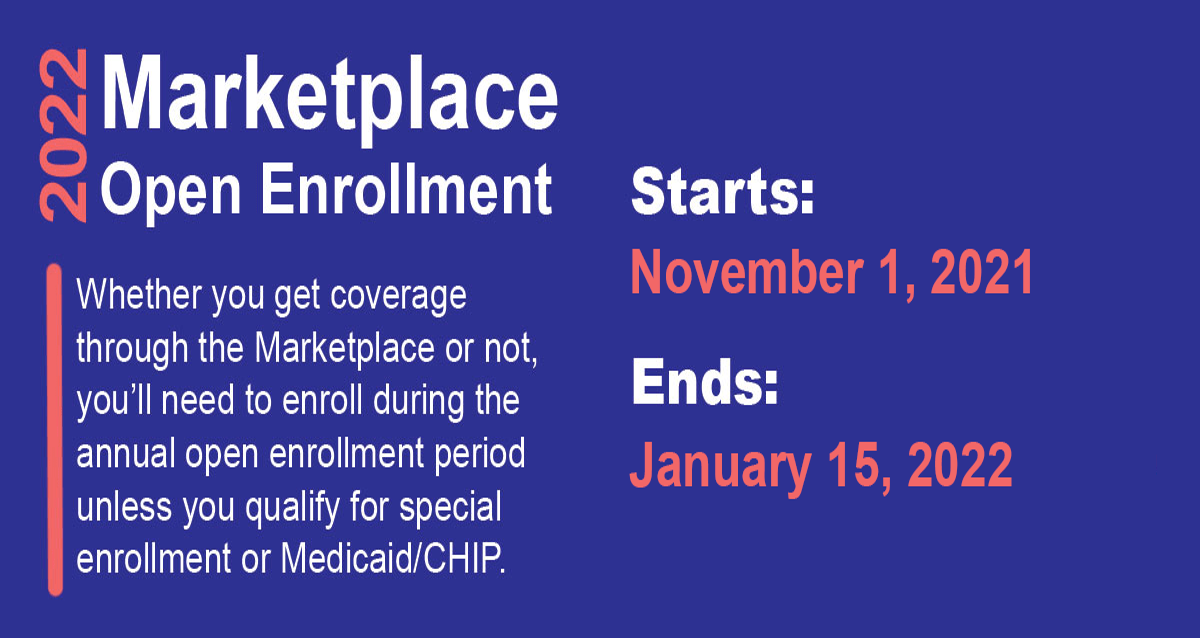

2022 OPEN ENROLLMENT

3 Enrollment Options

3 Enrollment Options

There are multiple options available to Individuals/Families who purchase health insurance following the Affordable Care Act (ACA, OBAMA CARE, health care reform).

- Private Health Insurance (aka-direct market) – We can help you choose which carrier and health plan is right for you. You as an individual or family would want to go this direction if you were not able to qualify for a tax subsidy (assistance paying your premium) or would like to deal directly with the insurance carrier vs healthcare.gov.

- Subsidized Health Plan – Do you qualify? – Still Confused? Call our office or make an appointment and one of our licensed insurance agents will walk you through all the steps. 541-929-2788

- Medicaid/OHP/Free Health Care Program/Welfare – We have many resources available to help enroll in the free health care program.

How Can We Help!

The educated and licensed insurance agents at RJS and Associates are contracted to sell all the insurance policies in Oregon. But our job doesn’t stop there. At RJS and Associates we pride ourselves in connecting with our clients throughout the year. Some examples of the services that we provide are below:

- EDUCATION AND ENROLLMENT – We want to make sure that we educated and assist you in choosing the best health plan for you and your family.

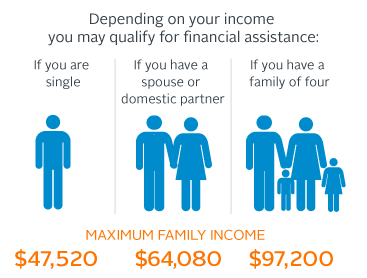

- APPLICATION FOR ASSISTANCE WITH PREMIUMS – aka. Subsidies/Tax Credits/Lowered Monthly Premiums. Our Insurance Agents have undergone extensive training and education on assistance with determining eligibility for premium assistance.

- CLAIMS ASSISTANCE – Have you ever had to fight with an insurance company to get a claim resolved? Yuck! Let us help, we have additional avenues to help expedite these processes.

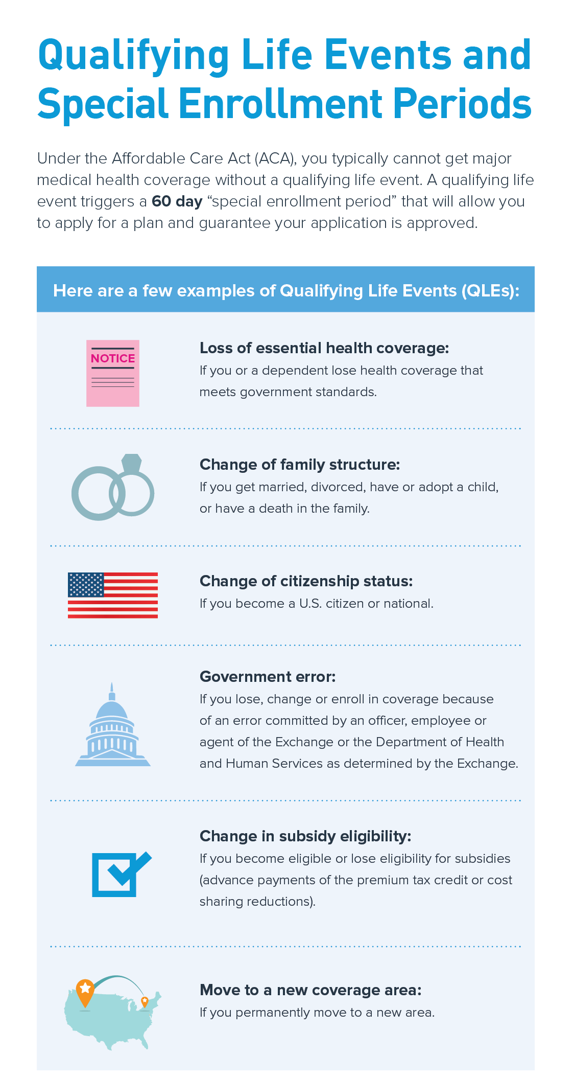

- INCOME AND LIFE CHANGES – It is important to report any changes in income and changes to your household to RJS and Associates as soon as possible to avoid a penalty on your taxes. *only applicable for those individuals enrolled in MEDICAID OR HEALTHCARE.GOV.

- Prescriptions, premium and other reimbursement assistance.

- Do you own a company? – RJS and Associates also handles employer health plans. Ask us what is better for you and your business.

Taxes & Forms

If you purchased a Qualified Health Plan (QHP) through HealthCare.gov and received an advance premium tax credit (APTC) to lower the cost of your premiums, you must report the amount of tax credit you received when you file your federal income tax return. HealthCare.gov will send IRS Form 1095-A (Health Insurance Marketplace Statement) to people who purchased a QHP. Form 1095-A includes important information you will need to complete your tax return. Keep Form 1095-A for your records.

Direct Market & Oregon Health Plan: If you or someone in your household qualified for and received coverage from the Oregon Health Plan (OHP), Oregon’s Medicaid and Children’s Health Insurance Program (CHIP), or an insurance carrier directly, you must report which months of the year you had OHP when you file your federal income tax return. You will receive an IRS Form 1095-B from the Oregon Health Authority, or your insurance carrier directly. The Form 1095-B includes information about your coverage that you will need to complete your tax return. You will need a Form 1095-B even if you had OHP , or direct insurance for only part of the year. Keep Form 1095-B for your records.

RJS & Associates works with all insurance carriers in the states of Oregon, Washington and California

Click the link below to apply for health insurance on your own. This individualized link gives you the access to apply for health insurance anytime anywhere with the benefits of our agency available to you at anytime.

*** Please note that the following link will allow you to see if you qualify for a tax credit/subsidy and apply directly with our trusted and secure third party vendor. If at any point you need assistance please make an appointment with one of our experienced agents, or call our office. 541-929-2788

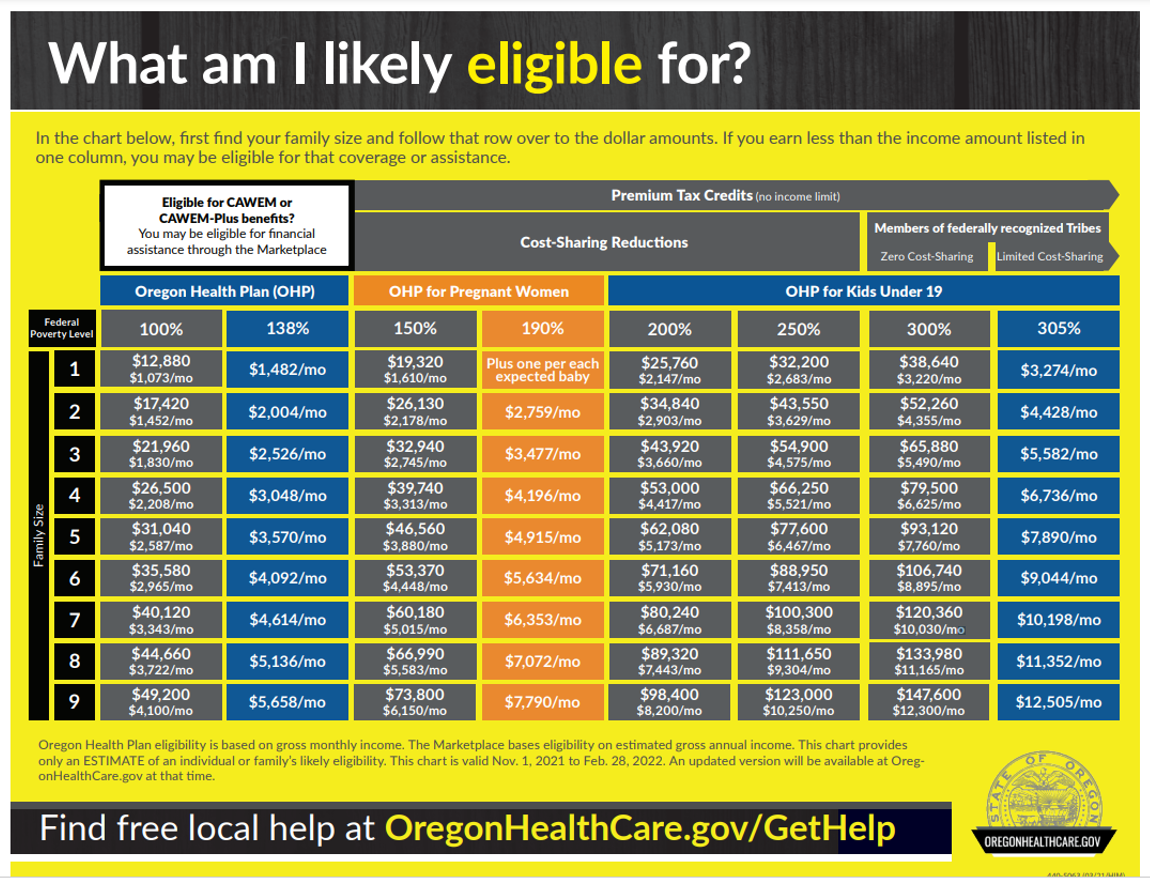

Information about Tax Penalties / Qualifying Life Events / Subsidies for Household size:

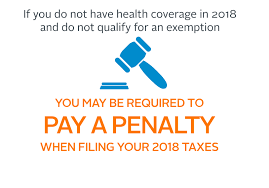

Be Aware of Tax Penalties For Not Enrolling

In 2019 the individual shared responsibility has been repealed. More information HERE.

Health care coverage is required under the Affordable Care Act. If you do not have health coverage in 2018 and do not qualify for an exemption, you may be required to pay a penalty when filing your 2018 taxes:

- 2.5 percent of your yearly household income

OR - The total yearly premium for the national average price of a bronze plan sold through the Marketplace

Assistance and/or resources available for the following:

The HealthCare Reform / ACA / Affordable Care Act / OBAMA Care / Healthcare.gov / Cover Oregon / Oregon Health Plan / Oregon Healthy Kids and many more…

Call 541-929-2788 or make an appointment for assistance